NL TIMES

NL TIMES

Designate Groningen earthquakes a national crisis, Ombudsman says

MONDAY, OCTOBER 25, 2021

The consequences of the fracking earthquakes in Groningen have all the features of a national crisis and should therefore be designated as such, National Ombudsman Reinier van Zutphen said. He wants this to keep attention on the situation in Groningen until homes are reinforced, damages are repaired, and residents feel safe, Trouw reports.

“I wanted to choose words that hit so hard that people think: damn it, now we really have to do something,” the National Ombudsman said in an interview with Trouw. “In one way or another, the attention for Groningen is disappearing. Things are taking too long, and the good things don’t really happen. This is a national crisis, which the government and administration have to deal with differently.”

Pump jacks at an oil field near Lost Hills, Calif. (David McNew/Getty Images)

Pump jacks at an oil field near Lost Hills, Calif. (David McNew/Getty Images)

PETER SMITH

Pittsburgh Post-Gazette

PETER SMITH

Pittsburgh Post-Gazette

Zoltan Ban

Zoltan Ban

Extracts from a weekly briefing by

Extracts from a weekly briefing by

Samuel Osborne

Samuel Osborne

By

By

Sectors

Sectors

By Heide Brandes: 28 July 2015

By Heide Brandes: 28 July 2015

Article by

Article by

Shell’s Arctic voyage marks beginning of peak oil era

Shell’s Arctic voyage marks beginning of peak oil era

“Predicting risk is also hard, the report noted, because there is no scientific consensus on just how powerful such quakes can be. The report estimated the effects of shocks up to magnitudes 6 and 7, while noting that some scientists have speculated that the catastrophic

“Predicting risk is also hard, the report noted, because there is no scientific consensus on just how powerful such quakes can be. The report estimated the effects of shocks up to magnitudes 6 and 7, while noting that some scientists have speculated that the catastrophic

Article by Richard A. Oppel Jr. and Michael Wines published by The New York Times:

Article by Richard A. Oppel Jr. and Michael Wines published by The New York Times: FROM AN ARTICLE BY CORAL DAVENPORT PUBLISHED IN THE NEW YORK EDITION OF THE NEW YORK TIMES ON 21 MARCH 2015

FROM AN ARTICLE BY CORAL DAVENPORT PUBLISHED IN THE NEW YORK EDITION OF THE NEW YORK TIMES ON 21 MARCH 2015

FROM TIMES LIVE – SUNDAY TIME SA: ARTICLE BY LONI PRINSLOO 15 March 2015

FROM TIMES LIVE – SUNDAY TIME SA: ARTICLE BY LONI PRINSLOO 15 March 2015

By John Donovan

By John Donovan BP can’t be immune to the upheaval. Today its job announcement is focused on the UK. But it won’t be long till it announces staff reductions in Houston, another of its important centres.

BP can’t be immune to the upheaval. Today its job announcement is focused on the UK. But it won’t be long till it announces staff reductions in Houston, another of its important centres.

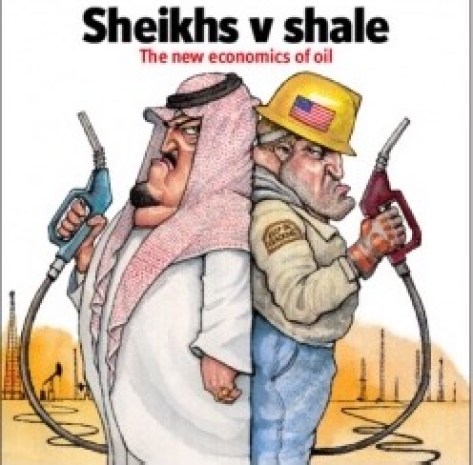

Abundant oil and gas have been extracted from underground rocks by blasting them with a mixture of water, chemicals and sand—“fracking”, in the jargon.

Abundant oil and gas have been extracted from underground rocks by blasting them with a mixture of water, chemicals and sand—“fracking”, in the jargon.

By John Donovan

By John Donovan

Royal Dutch Shell conspired directly with Hitler, financed the Nazi Party, was anti-Semitic and sold out its own Dutch Jewish employees to the Nazis. Shell had a close relationship with the Nazis during and after the reign of Sir Henri Deterding, an ardent Nazi, and the founder and decades long leader of the Royal Dutch Shell Group. His burial ceremony, which had all the trappings of a state funeral, was held at his private estate in Mecklenburg, Germany. The spectacle (photographs below) included a funeral procession led by a horse drawn funeral hearse with senior Nazis officials and senior Royal Dutch Shell directors in attendance, Nazi salutes at the graveside, swastika banners on display and wreaths and personal tributes from Adolf Hitler and Reichsmarschall, Hermann Goring. Deterding was an honored associate and supporter of Hitler and a personal friend of Goring.

Royal Dutch Shell conspired directly with Hitler, financed the Nazi Party, was anti-Semitic and sold out its own Dutch Jewish employees to the Nazis. Shell had a close relationship with the Nazis during and after the reign of Sir Henri Deterding, an ardent Nazi, and the founder and decades long leader of the Royal Dutch Shell Group. His burial ceremony, which had all the trappings of a state funeral, was held at his private estate in Mecklenburg, Germany. The spectacle (photographs below) included a funeral procession led by a horse drawn funeral hearse with senior Nazis officials and senior Royal Dutch Shell directors in attendance, Nazi salutes at the graveside, swastika banners on display and wreaths and personal tributes from Adolf Hitler and Reichsmarschall, Hermann Goring. Deterding was an honored associate and supporter of Hitler and a personal friend of Goring.

Deterding was the guest of Hitler during a four day summit meeting at Berchtesgaden. Sir Henri and Hitler both had ambitions on Russian oil fields. Only an honored personal guest would be rewarded with a private four day meeting at Hitler’s mountain top retreat.

Deterding was the guest of Hitler during a four day summit meeting at Berchtesgaden. Sir Henri and Hitler both had ambitions on Russian oil fields. Only an honored personal guest would be rewarded with a private four day meeting at Hitler’s mountain top retreat.

IN JULY 2007, MR BILL CAMPBELL (ABOVE, A RETIRED GROUP AUDITOR OF SHELL INTERNATIONAL SENT AN EMAIL TO EVERY UK MP AND MEMBER OF THE HOUSE OF LORDS:

IN JULY 2007, MR BILL CAMPBELL (ABOVE, A RETIRED GROUP AUDITOR OF SHELL INTERNATIONAL SENT AN EMAIL TO EVERY UK MP AND MEMBER OF THE HOUSE OF LORDS:

MORE DETAILS:

MORE DETAILS:

A head-cut image of Alfred Donovan (now deceased) appears courtesy of The Wall Street Journal.

A head-cut image of Alfred Donovan (now deceased) appears courtesy of The Wall Street Journal.