ExxonMobil, Chevron, Total, Royal Dutch Shell, and British Petroleum are the five biggest players on the index, which includes 85 other majors. Together, they have lost $115 billion in market value since the beginning of April, Bloomberg reports, according to World Oil.

By Zainab Calcuttawala – Jul 04, 2017, 5:00 PM CDT

Operational improvements in shale and non-shale oil drilling, on top of lower expenses for oilfield services and access to pipeline capacity, have driven down the costs of producing the fossil fuel since the 2014 market crash. But the increase in output has forced barrel prices into a deeper bearish market, causing further damage to corporate bottom lines.

This trend is mapped clearly in the MSCI’s World Energy Index, which measures the progress of large and medium sized companies in 23 oil-producing countries on a quarterly basis. ExxonMobil, Chevron, Total, Royal Dutch Shell, and British Petroleum are the five biggest players on the index, which includes 85 other majors. Together, they have lost $115 billion in market value since the beginning of April, Bloomberg reports, according to World Oil. read more

Like this:

Like Loading...

This website and sisters

royaldutchshellplc.com,

shellnazihistory.com,

royaldutchshell.website,

johndonovan.website, and

shellnews.net,

are owned by

John Donovan. There is also a

Wikipedia segment.

![]()

Jul. 5, 2017 11:40 AM ET|About: Exxon Mobil Corporation (XOM)|By: Carl Surran, SA News Editor

Jul. 5, 2017 11:40 AM ET|About: Exxon Mobil Corporation (XOM)|By: Carl Surran, SA News Editor

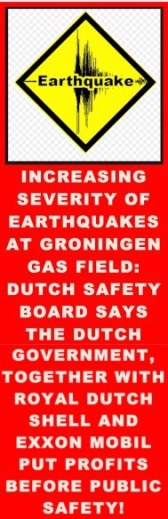

One team of analyst contends Exxon’s organic growth could be hurt by problems at its Groningen gas field.

One team of analyst contends Exxon’s organic growth could be hurt by problems at its Groningen gas field.

Royal Dutch Shell conspired directly with Hitler, financed the Nazi Party, was anti-Semitic and sold out its own Dutch Jewish employees to the Nazis. Shell had a close relationship with the Nazis during and after the reign of Sir Henri Deterding, an ardent Nazi, and the founder and decades long leader of the Royal Dutch Shell Group. His burial ceremony, which had all the trappings of a state funeral, was held at his private estate in Mecklenburg, Germany. The spectacle (photographs below) included a funeral procession led by a horse drawn funeral hearse with senior Nazis officials and senior Royal Dutch Shell directors in attendance, Nazi salutes at the graveside, swastika banners on display and wreaths and personal tributes from Adolf Hitler and Reichsmarschall, Hermann Goring. Deterding was an honored associate and supporter of Hitler and a personal friend of Goring.

Royal Dutch Shell conspired directly with Hitler, financed the Nazi Party, was anti-Semitic and sold out its own Dutch Jewish employees to the Nazis. Shell had a close relationship with the Nazis during and after the reign of Sir Henri Deterding, an ardent Nazi, and the founder and decades long leader of the Royal Dutch Shell Group. His burial ceremony, which had all the trappings of a state funeral, was held at his private estate in Mecklenburg, Germany. The spectacle (photographs below) included a funeral procession led by a horse drawn funeral hearse with senior Nazis officials and senior Royal Dutch Shell directors in attendance, Nazi salutes at the graveside, swastika banners on display and wreaths and personal tributes from Adolf Hitler and Reichsmarschall, Hermann Goring. Deterding was an honored associate and supporter of Hitler and a personal friend of Goring.

Deterding was the guest of Hitler during a four day summit meeting at Berchtesgaden. Sir Henri and Hitler both had ambitions on Russian oil fields. Only an honored personal guest would be rewarded with a private four day meeting at Hitler’s mountain top retreat.

Deterding was the guest of Hitler during a four day summit meeting at Berchtesgaden. Sir Henri and Hitler both had ambitions on Russian oil fields. Only an honored personal guest would be rewarded with a private four day meeting at Hitler’s mountain top retreat.

IN JULY 2007, MR BILL CAMPBELL (ABOVE, A RETIRED GROUP AUDITOR OF SHELL INTERNATIONAL SENT AN EMAIL TO EVERY UK MP AND MEMBER OF THE HOUSE OF LORDS:

IN JULY 2007, MR BILL CAMPBELL (ABOVE, A RETIRED GROUP AUDITOR OF SHELL INTERNATIONAL SENT AN EMAIL TO EVERY UK MP AND MEMBER OF THE HOUSE OF LORDS:

MORE DETAILS:

MORE DETAILS:

A head-cut image of Alfred Donovan (now deceased) appears courtesy of The Wall Street Journal.

A head-cut image of Alfred Donovan (now deceased) appears courtesy of The Wall Street Journal.